Property Owner/Taxpayer Responsibilities and Reminders

Be aware of the important dates and deadlines for payments, applications for property tax relief and assessment appeals.

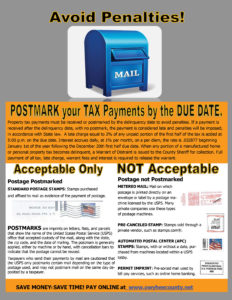

It is particularly important that you be aware of your property tax due dates. Tax bills are mailed on each parcel, however, failure to receive a tax bill does not excuse the taxpayer from paying the taxes, late charges and interest accrued, if any.

Be sure to notify the assessor’s office whenever your mailing address changes. When mailing your tax payment, be sure the envelope is U.S. postmarked on or before the due date.

If you will be traveling or out of the country at the time taxes are due, contact our office for an “estimated tax amount” so that you can prepay or make other arrangements to pay by the due date.

Proof of payment of property taxes is the responsibility of the taxpayer [I.C.63-1306 (2)]. Be sure to keep accurate records, receipts and cancelled checks documenting your payment.

Important Deadlines

December 20: Last day to pay full tax payments or first half tax payments without late charge and interest on the first half

January 2: First day to apply for Homeowner’s Exemption or Circuit Breaker Benefits. New for 2021 – Homeowner’s Exemption can be applied for at anytime of the year.

April 15: Last day to apply for Circuit Breaker Benefits. For information on Homeowner’s Exemption or Circuit Breaker Benefits, Call the Assessor’s office at 495-2817.

First 3 weeks in June: Period when you may appeal Assessment Values for current year. Check Assessment Notice for Homeowner’s Exemption if applicable.

June 20: Last day to pay second one-half tax payments for last year without a late charge and interest. If delinquent, interest is calculated from January 1.

Credit Card or Echeck Paying Options

In order to offer you the convenience of using your bank card, a non-refundable fee of 2.50% will be added to your transaction.

All Credit Card options: By Phone, in Person, and Online – will include this convenience fee. This fee goes to our third party provider, Access Idaho.

Check Option: Convenience fee $1.00. The County does not keep any portion of this fee.

Pay Online: Click to pay your property taxes online by check or credit card.

Additional Information

You can find additional information about Idaho’s Property Tax by visiting Idaho State Tax Commission web site.

2023 Property Tax Bills

2023 PROPERTY TAX BILLS WILL BE MAILED OUT THE END OF NOVEMBER. IF YOU HAVE A NEW ADDRESS, PLEASE CONTACT THE ASSESSOR’S OFFICE AT 495-2817 TO UPDATE YOUR INFORMATION.

TREASURER CONTACT

Annette Dygert, Treasurer

adygert@co.owyhee.id.us

Mailing Address:

P.O. Box 128

Murphy, ID 83650

Location:

20381 State Highway 78

Murphy, ID 83650

Phone: 208-495-1158

Fax: 208-495-1173

Hours:

Monday – Friday

8:30am – 5:00pm

Treasurer: Annette Dygert

Chief Deputy: Gentry Stoumbaugh

gstoumbaugh@co.owyhee.id.us

Deputy: Brandi Long

blong@co.owyhee.id.us

![]()